Over the past few years the adoption of Artificial Intelligence (AI) and Machine Learning has been a key driver of innovation in many industries. Tasks like facial recognition or assisted medical imaging ― unthinkable just a few years ago ― are now possible thanks to models that learn from data to understand and predict the behaviour of complex systems. And investing is no exception when it comes to the benefits of adopting AI. Indeed, the new landscape is taking shape at a time of increasing complexity and competition in financial markets, making the chase to find information hidden in the noise more important than ever.

Participants of the 1956 Dartmouth Summer Research Project on Artificial Intelligence in front of Dartmouth Hall. From right to left, Claude Shannon (front right), John McCarthy (back right), Marvin Minsky (centre), Ray Solomonoff (front left), and Nathaniel Rochester (back left).

Where does Artificial Intelligence come from?

1956. A brainstorming session was taking place in Hanover, New Hampshire. There, a workshop gathered a dozen Mathematicians, Physicists, and Computer Scientists to discuss their ideas, opinions, and visions about the future of technology and computer science. Although no one could have imagined how important their work would have become, it was during that period that the technological revolution we are witnessing today effectively started, and the first time that the term “Artificial Intelligence” was coined.

Just in a few years, as computers started solving algebraic problems and speaking basic English, large amounts of funding were directed towards AI research. However, the enthusiasm did not last very long: low computing power and a general lack of data severely affected researchers that struggled to deliver on the original high expectations. Regardless, AI remained one of the most researched topics, especially in Academia. This eventually resulted in an incredible amount of theoretical research starting to be successfully applied as soon as data and computing power grew.

This remarkable growth, well described by the famous Moore’s Law, made the training of AI models more efficient and less costly. And in the grand scheme of things, AI eventually got out of computer science laboratories, and into the daily workflow of billions of people. In other words, the AI we ended up developing has been very different from the one commonly seen in sci-fi movies. In fact, AI’s most widespread applications are narrower, and more reliable, than commonly thought of.

What is “weak” AI?

Today, a significant portion of current AI applications are directed towards solving specific problems. They belong to the “Weak AI” world instead of the “Strong” one. Strong AI is a field of AI research focused on creating something capable of thinking and solving problems like humans. On the contrary, Weak AI reflects a more practical use of this technology to target well-defined problems.

Within the world of “Weak AI'', several achievements have occurred in the last few years. For example, AI has greatly contributed towards space exploration. Its impact in this sector can be seen by analysing the evolution of spacecrafts’ internal dashboards. The image below compares the 1985 Space Shuttle Atlantis with the 2020 SpaceX Crew Dragon.

The inside dashboard of the Space Shuttle Atlantis (1985) and Crew Dragon (2020)

When in May 2020, an AI autopilot conducted the Crew Dragon up to 20 metres from the International Space Station, “Weak AI” contributed to making space exploration safer and more efficient, detecting any dangers in space missions, such as sensor malfunctions.

AI is already everywhere, and investments are no exception

Just like AI contributed to making space exploration safer and more efficient, it also had a significant impact in various company processes among large institutions, ranging from automotive, to healthcare & pharma, high tech/telecom and also investments, as it was outlined in a recent study by Stanford, along with Bloomberg, Google, and McKinsey. According to the report, processes, risk management, and product innovation are the areas in which AI is most heavily adopted. Thanks to the automation of low value-added activities, these areas have received a boost from AI adoption, since it allows human resources to participate in tasks of greater value, thus significantly increasing performance and revenues.

Applications and AI Adoption Levels in Different Industries

Source: Stanford 2022

What happens when you adopt AI to support investment decisions?

The applications of AI in the world of investments are becoming more and more frequent, mature and reliable, to the point that AI is quickly becoming a breakthrough in modern investment management. In this sense, AI advancements in investing appear as a necessary evolution rather than a complete revolution of existing techniques.

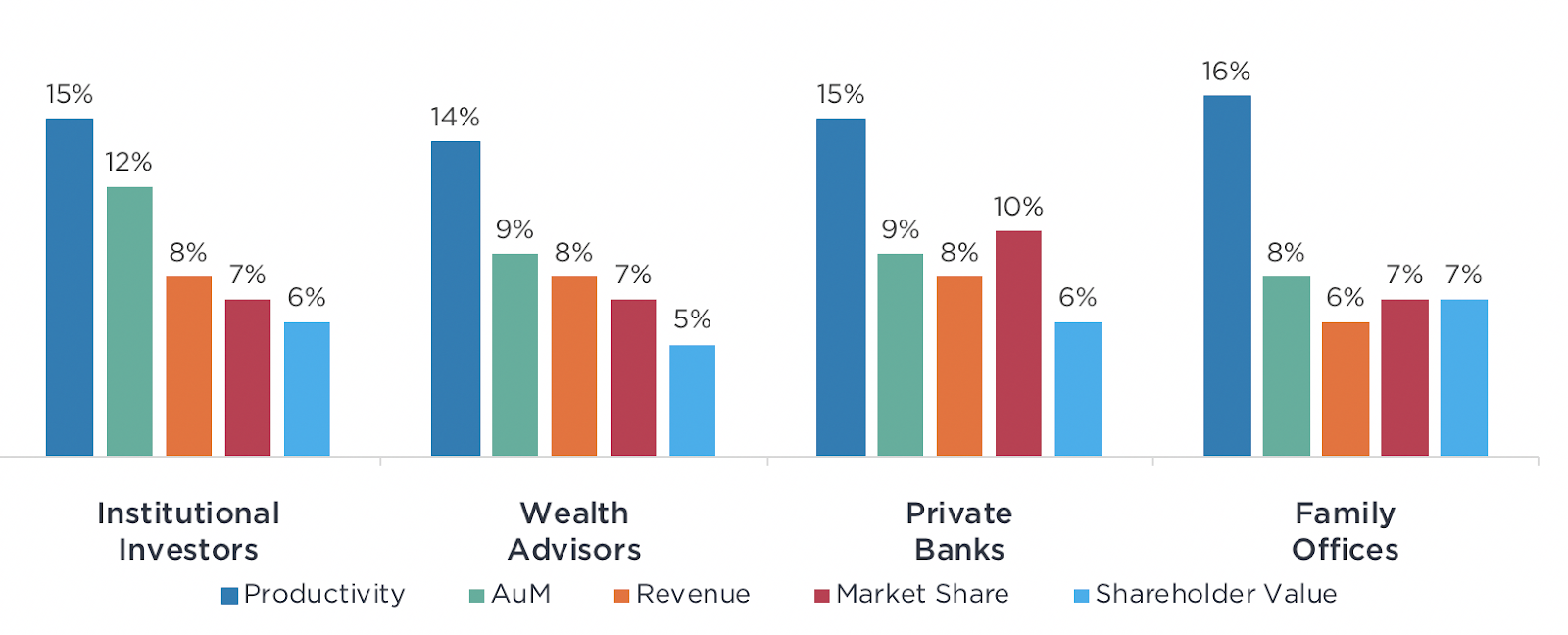

From the development of unbiased investment strategies to the construction of tailor-made and diversified portfolios, they are giving investors a chance to finally close the gap between theory and empirical evidence. As highlighted by Deloitte, the benefits for institutional investors that adopt AI in the investment process are an average increase in productivity of 14%, with an AuM growth of over 8% and in revenues of 7%. Moreover, these effects appear to be consistent whether we talk about traditional institutional investors, family offices, private banks or wealth managers.

Why Institutional Investors are adopting AI, and what is its value add

Source: Deloitte ThoughtLab “Wealth & Asset Management 4.0”

AI is setting a new gold-standard to reliably and unbiasedly shape investment strategies, pushing Asset and Wealth Managers to permanently redefine how their investment decisions are made. It can tackle time-consuming and bias-prone tasks, understanding how to extract investment signals from markets’ background noise. It shouldn't come as a surprise to see more and more Asset and Wealth Managers seeking to integrate AI into the investment process, given the significant impact it can have on AuM, productivity, revenues, and more. No one could have pictured how significant that brainstorming session in 1959 would be for today’s modern world of investments. It was right there, where a dozen Mathematicians, Physicists, and Computer Scientists forever reshaped the investment process to be more adaptive, reliable, and customisable.